Podcast: Play in new window | Download

In this podcast, Catherine Weetman talks to Noreen Kam and Michael Brown of LUP Global, in Australia, about the circular asset management solution they’ve developed for LUP Global’s customers.

In this podcast, Catherine Weetman talks to Noreen Kam and Michael Brown of LUP Global, in Australia, about the circular asset management solution they’ve developed for LUP Global’s customers.

We hear about the opportunities for companies to reduce their capex, improve the performance and lifetime cost of equipment, and to recover value from the equipment at the end of its service period. Michael explains how this approach is normal in the airline industry, where often the airline doesn’t own anything – the plane, the engines, even the seats. Everything is owned, provided and maintained by the suppliers – you may have heard of the Rolls Royce example, selling power by the hour so you purchase the performance of the engine, instead of buying the engine itself.

Noreen and Michael realised that many other industry sectors don’t use these approaches, and so they are helping companies benefit from circular asset management, starting with laboratory equipment.

Podcast host Catherine Weetman is a circular economy business advisor, workshop facilitator, speaker and writer. Her award-winning book includes lots of practical examples and tips on getting started. Catherine founded Rethink Global in 2013, to help businesses use circular, sustainable approaches to build a better business (and a better world).

Stay in touch for free insights and updates…

Read on for a summary of the podcast and links to the people, organisations and other resources we mention.

You can subscribe to the podcast series on iTunes, Google Podcasts, PlayerFM, Spotify, TuneIn, or search for “circular economy” in your favourite podcast app. Stay in touch to get free insights and updates, direct to your inbox…

Links we mention in the episode:

- LUP Global lupglobal.com

- Email: info@lupglobal.com

- Noreen Kam on LinkedIn https://www.linkedin.com/in/noreen-kam-mcips-75586119/

- Michael Brown on LinkedIn https://www.linkedin.com/in/michaelbrown111/

- Blog: Why ‘semi-circular’ strategies are a sustainable step forward https://www.rethinkglobal.info/semi-circular-strategies/

- Podcast: Ep 24 – Steve Haskew of Circular Computing https://www.rethinkglobal.info/episode-24-steve-haskew-of-circular-computing/

- White paper from Circle Economy (2020) What tracking assets can do for the circular economy – tracking assets further extends product lifetime and improves finance-ability of Product-as-a-Service Models https://www.circle-economy.com/news/what-tracking-assets-can-do-for-the-circular-economy-2

About Noreen Kam and Michael Brown

Noreen Kam founded LUP Global at the end of 2017 after recognising an opportunity to contribute to the Circular Economy.

Noreen Kam founded LUP Global at the end of 2017 after recognising an opportunity to contribute to the Circular Economy.

Prior to LUP, Noreen was Executive Director at AUZ Country Carriers, and on the Board of Community Support Frankston, the second largest agency of its kind in Victoria, Australia helping over 13,000 homeless and disadvantaged per annum.

Utilising the spare capacity of AUZ Country trucks and warehouse space, we reached out to our 1800+ client network (all businesses) to collect non-perishable donations which we would transport and store for free to deliver to the charity as and when they needed it. Over the first year, we collected over 20 tonnes worth of goods otherwise earmarked for landfill.

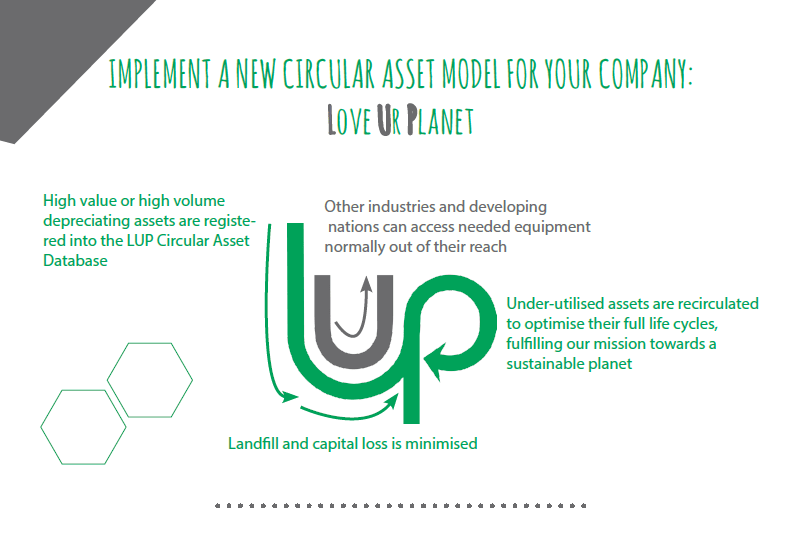

Recognising the opportunity with the enormous amount of good quality assets that otherwise end up as ‘landfill’, by leveraging on her global Supply Chain experience and networks, LUP Global was founded to re-allocate high value or high volume under-utilised assets from companies, to other industries and countries that could utilise them to the fullness of their lifecycle.

Noreen has over 20 years experience in Supply Chain Management, with a particular focus on Procurement and Logistics, working in a variety of industry sectors from Life Sciences, Biotechnology, to FMCG, Education and Consulting. She holds a Masters in Supply Chain graduating with First Class Honours from the University of Melbourne and is a Member of the Chartered Institute of Procurement and Supply (MCIPS).

Michael Brown joined LUP Global as Chairman in July 2019; the ability to apply his considerable experience in the pursuit of the goals of Lup to optimise asset lifecycles and develop the circular economy offer a new and exciting challenge.

Michael Brown joined LUP Global as Chairman in July 2019; the ability to apply his considerable experience in the pursuit of the goals of Lup to optimise asset lifecycles and develop the circular economy offer a new and exciting challenge.

He is an internationally experienced operations executive. Commencing his career with Kodak Australasia Pty Ltd in Coburg, Melbourne; he then joined the parent company Eastman Kodak and spent 15 years working across Asia, USA and England in a variety of leadership roles in Supply Chain and Finance.

Returning to Australia in 2002, he worked in a number of Consulting roles before joining Whirlpool as Director Operations and then Qantas as Group General Manager Engineering Supply Chain. He then again worked in Consulting with a focus on Aviation and Health sectors before commencing his previous role as General Manager Supply Chain and Sourcing for Nexans Olex ANZ.

Michael holds a Masters in Supply Chain from the University of Melbourne and studied Business at Royal Melbourne Institute of Technology. He is also Member of the Chartered Institute of Purchasing and Supply (CIPS), Australian Institiute of Export (AIEX) and a Member of the Australian Institute of Company Directors (AICD)

LUP Global – Circular Asset Management services

Transcript

Add 4:20 to these timestamps to allow for the intro etc.

Catherine Weetman 00:02 I’ve known Noreen for a few years now. We got in touch through our mutual backgrounds in logistics and supply chains after I did a talk for the Institute of Logistics down in the south of England. I’ve been really impressed by all the brilliant work Noreen has been doing with LUP Global, and I’m delighted to talk to her and her colleague, Michael Brown, today to find out what’s happening with the LUP Global network, and also the circular asset management services. So Noreen and Michael, welcome to the Circular Economy Podcast.

Noreen Kam 00:34 Thank you. Thank you so much, Catherine. It’s absolute pleasure to be here today with you.

Catherine Weetman 00:40 So first of all, let’s tell the story by giving a bit of background to LUP Global and how you got going and the kind of things that you’re doing for your customers now.

Noreen Kam 00:51 I’ll let Michael start with that.

Michael Brown 00:56 Okay, so thanks Catherine for the opportunity. So, LUP has been around for over two years now. We’re entering our third year of business, Noreen is the founder of the business. She’s the passionate circular economy leader in our business and, and many of us are inspired by her zeal and fervour for this, this enterprise. Noreen and I have a relationship, we’ve known each other for around 10 years, we completed a Master’s of supply chain here in Melbourne at the University of Melbourne. So Noreen invited me just over a year ago to join LUP and provide support. So act as the role of chair. Part of my background is in circular asset monitoring circular asset management field, largely from a role that I had at Qantas some years ago. And a lot of our processes, if you will, relate to the practices that have occurred in heavy industry, aviation mining utilities where there’s The commercial imperative to drive circular asset management and some of what we’re now trying to develop and the actions that we breathe, and live founded on some of the learnings that have come from that experience.

Catherine Weetman 02:15 Good stuff. And Noreen you wanted to talk a bit about the LUP network that you’ve been growing over the last few years as well?

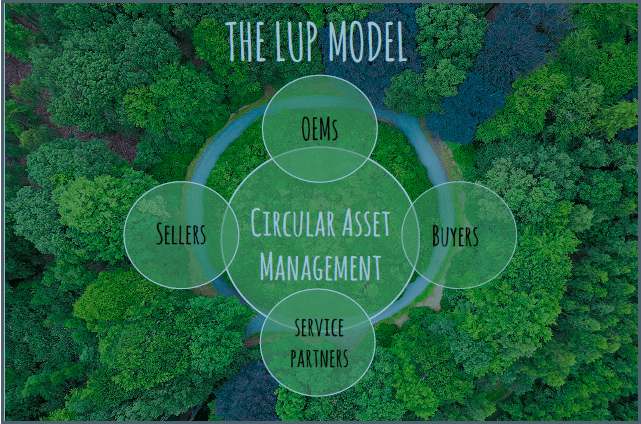

Noreen Kam 02:27 Yes, definitely. So we’re really excited because our passion is really to prolong the life cycle of assets to minimise landfill. And we what we’ve created is we’ve established a network that’s all about the full lifecycle of the asset, considering from the start all the stakeholders from the original equipment manufacturer, to the buyers of the assets, to building a network of service partners to support those assets in their second life or subsequent lives and In the mindset shift of sellers of the assets, as opposed to that traditional linear mindset of procuring, using and then disposing, which is the vast majority of what we’ve seen so far.

Catherine Weetman 03:13 Yeah, and when we, when we’ve talked before about Michael’s background, then that kind of model is much more common in aviation. And Rolls Royce is one of the best-known examples of selling performance and services rather than selling the equipment with their power by the hour model for airline engines. And I think you’d seen that and talked to Michael and realised that there’s a potential to apply those same principles across all kinds of different sectors and, and for a whole range of different assets. And how you’re seeing really underused, or underutilised assets everywhere and realised how much value is just being either left on the table, or it’s even worse it’s going to landfill and being completely lost.

Noreen Kam 04:10 Exactly. So my background also was in a laboratory, a food testing laboratory. So we’ve ended up starting laboratory equipment, generic laboratory equipment as assets, type of assets but more and more we’re diversifying and growing into other industries, such as manufacturing, but generally the assets that we focus on them or the portable plug-and-play higher value assets just due to capacity as a start-up, I guess. But what we’ve noticed is that some people in organisations, they might have a depreciation budget or requirement to upgrade their equipment every few years. So we’ve been with a five-year cycle. And then but these assets though, have at least 12-15 plus years lifecycle left in them. So we’re seeing assets that end up in landfill just as you do – it’s not their core business to try to find a secondary home for them or anything and they’re ending up in landfill well before their expiry date.

Catherine Weetman 05:14 Yeah. And I guess there’s also the issue of… even though it’s not somebody’s core purpose of their role to find another outlet or another use for the asset at the end of time. There’s also the issue of things ending up in any kind of fire-sale. We’ve talked about x-ray machines and scanners and things like that in the past, haven’t we, where it’s a really valuable piece of equipment and it’s still working. But you know, a better models come along, and all of a sudden, there’s no room to store that quite big piece of equipment anywhere. And so it’s sold off, you know, quick as possible – just to clear it out of the system.

Noreen Kam 06:04 Yeah, exactly. So one thing that is quite unique about our model is we try to partner with all of our clients and stakeholders long term. So it’s not about being reactive when they do need to dispose of the asset, it’s trying to understand what their asset base from the start and if they’re working towards certain depreciation cycles, they can actually register it within a secular Asset Database upfront. So it’s almost like if you were buying a car and you knew you weren’t going to use it to the end of its life, then you’re going to maximise and make sure that it’s got the full-service history and everything to get maximum value out of it when you’re upgrading to your next vehicle. So we do that and we partner with organisations and we’ve Michael’s amazing background, as well. We’ve been able to refine service offering in terms of how do we help educate our clients so that they are maintaining and keeping those service records Within everything so that we’re optimising the value for it at the end of their life with it.

Catherine Weetman 07:06 Great. So in terms of the how it works, maybe you could talk us through the kind of steps that you go through with, with a client for, you know, a typical Asset Management Service.

Noreen Kam 07:19 Sure. And so it depends on where they sit within the LUP network model. But let’s use a buyer as an example. So a buyer of an asset generally works with us. We’ve got a case study where we worked with the company that was setting up a new laboratory, and we worked with them and got their capital plan. One year out from when they were going to build this new laboratory. They identified that they needed 16 assets to set up this lab and the asset base is continuously growing but at that time, over that one-year period, we’re able to source nine out of those 16 assets proactively within our circular assets database and network. And over that period of time, we were able to save them a 54% saving against the new market equivalent to that same equipment. But what is really as impactful as well is that a lot of the equipment that we come across, over 60% was actually under three years old. So we’re not actually talking about equipment that’s really at the end of its life or anything, most of it has recently come out of the OEM warranty. They’re still in excellent condition, but just due to different factors – it could be a lab got shut down, shortly after it was set up and new owners bought it over and then they didn’t have use of that equipment. It could be incorrect Capex purchases. Yeah, it could be people have certain grant or government funding or Capex budgets that is, they don’t use that year, they lose the following year. So it could be multiple reasons. Yeah. So that we were picking up these sorts of assets.multiple reasons. Yeah. So that we were picking up these sorts of assets.

Catherine Weetman 09:04 Yeah. So just so the time I’m clear, not only helping people find disposal routes for their end of use assets, but you’re also helping companies find pre-used equipment and assets, instead of them having to buy new and that’s where that 54% saving comes from.

Noreen Kam 09:28 Exactly. So we don’t like really using the term ‘used’ so much. We tried to refer to underutilised because it hasn’t been utilised to the fullness of its lifecycle. So that’s from the sort of buyers perspective, but then from the sellers perspective, we are working with organisations so they might have been they would have been initial buyer and registered with us because they knew they were going to depreciate their asset. So prior to the depreciation they might be working six months out or a year out, even the longer the visibility that we have, the better then Once we know we will actively source those particular asset buyers as well in the background, whilst that asset is depreciating off their books so that we’ve got, we can reallocate that as soon as they’re finished using it. So it’s actually saving any potential storage costs, any disposal costs. And we’ve also modelled out what the standard lifecycle of some assets are from the other side from the sellers perspective. And we’ve been able to show total cost of ownership saving of 40% against the standard lifecycle under a linear model. This is a circular asset model.

Catherine Weetman 10:34 Right? And I guess, Michael, maybe you can compare and contrast this with your aviation experience that starting to think about the total cost over a lifetime gets people thinking differently when they can see that you can either save some money at the front end by buying something that’s already been in use, or you can save money at the end of the use cycle by finding a partner to pay money for that, how does it compare?

Michael Brown 11:11 So in aviation just as a commercial imperative, managing the asset to the fullest of its uses, is one of the cornerstones of trying to run an airline efficiently. So an asset may have multiple owners or its lifecycle and or go from different levels of operators. As fleets retire or as new airlines come and stream those assets continue to get used multiple times through the life. The secret behind it is aviation and heavy industry sectors are very good at managing the asset and recording its use. And equally in practices around warranty management. Maintaining when you do there’s a regulatory imperative that sits in aviation where you do need to maintain maintenance records that suit the regulator. So there’s a lot of discipline around process and, and what we find is we talked to clients, people don’t understand the value that’s associated with that, and nor introduce the value of your car like you know, if you maintain your car and keep good records, that helps enhance the value of that asset that end of its life. Or when you want to turn that asset over, the same principles apply to any of the assets that could be considered under circular economy, whether it be office equipment, or barter equipment, manufacturing equipment, you know, anything that’s used in a production, transportation sense, everything needs an appropriate register capability to record the use, manage use, and there’s a lot of leakage here, just in how warranties are managed. But as we try to consider using that asset to the fullest of its life, the discipline around that record keeping is really critical. And that’s an element that we’re finding disappointing. Businesses don’t see these pieces of equipment as assets, even though they’ve been Capex approved and Capex purchased. If you look in some of the hospital sectors and some of the other medical sectors, it’s treated like a consumable, it’s no longer usable, I’ll get it repaired, rather than preventive maintenance regimes and other activities that again, come from the aviation sector that should be used across other sectors.

Catherine Weetman 13:29 Hmm. Yeah, that’s interesting. And I guess it kind of reminds me of a completely different sector. But when I was at DHL, we were working with some retailers, and we’re trying to work out why they had so much excess stock. And these were kind of you know, fast-moving consumer goods and so on. And what we found was that the buyers were bonused, based on the theoretical margin of what they bought, so say they bought 100 Or 1000 kettles and the margin was five pounds per kettle, all of that was counted for their bonus as soon as it made the purchase. So if they only sold one of those kettles, because you know, it was actually more expensive than, than the competitor’s kettle that never got tracked. So they always look like they’ve done really well. And yet they bought something that, you know, just sat in a warehouse for years and then and several years later might have been written off and there was no kind of closing the loop.

Michael Brown 14:33 Because one of the elements on that – One of the elements that relates back to the Master’s programme that Noreen and I did, is one of the topics led by an eminent professor was around the incentivization in the supply chain and incentives drive behaviour. And that’s very clear here. And so, in one of the elements we look at, and certainly one of the things we try and educate people on is the mind-shift that’s required. We need to get a mind-shift movement. Today, most people still buy linear. And so the procurement community looks at that and look at it in terms of a risk-averse position, and the safety that comes from buying new. So there are some other elements that we need to look at in terms of the procurement community and to encourage circular procurement does require a mindset shift and new behaviours in terms of how you evaluate equally, and that is the incentive that sits behind that in the procurement community and the risk balance that’s required. There’s another important feature of trying to make that shift.

Catherine Weetman 15:41 Yeah, I think there’s a lot to do isn’t there in terms of encouraging people to think differently about, you know, it’s kind of habitual behaviour that people have adopted for years and corrected to think differently and adopting this mindset of you know, what’s, what’s the total cost of ownership or total cost? Have use whilst it owns it. And what can I do at the start of the process to reduce the cost? What can I do throughout the process to reduce the cost by as you say, making sure you’re on top of maintenance instead of emergency repairs, which could be more expensive and incur downtime. And then what can I do at the end of the process to maximise the, you know, the end-of-life, return, you know, and even if you budgeted for a resale value at the end, the more that you do to maintain it, and the more that you do to plan ahead for the disposal route, the more chance there is that you’ll actually exceed that and lower the cost of ownership still further.

Michael Brown 16:47 Correct. It’s a full assessment of the lifecycle and managing your asset with some discipline. It’s an element, as we’ve said, in our experience, there’s a lot of waste that sits there in another number of sectors just because there’s no practice, there’s no discipline in terms of applying the principles that we’ve just talked about.

Catherine Weetman 17:07 And are you providing the asset management registers and supporting people with the behaviour change that they need to do on a day to day basis?

Michael Brown 17:17 So one of our offering is to provide some consulting support and help businesses to establish those regimes. So that’s one of the elements that we work so not only are we in the business of trying to move those assets and help those assets, find new homes, but to educate.

Michael Brown 17:32 That’s a key platform of what the LUP Global model does.

Catherine Weetman 17:36 And what kind of reactions and feedback Are you getting now that you’re starting to talk to more and more customers about this?

Michael Brown 17:45 It’s an interesting element of – maybe let Noreen make a comment as well. But it’s trying to move the minds is really the the barrier that’s there.

Noreen Kam 17:57 Sorry, it’s quite interesting, in terms of the reaction, I’d like to give the example with the OEMs, for example, because it’s the start of the supply chains as well, but in terms of the creation of the assets and manufacturing the asset. So different OEMs have got different requirements or legislation in terms of what they do, and sometimes their priority is often to sell in the new asset. So sometimes it can be also planned for obsolescence on making the consumables obsolete over a number of years for not providing that service support, but other OEMs, a lot of OEMs are also seeing the shift that we need to towards a circular model as well and looking at different avenues for that. So it’s been quite mixed in terms of that. Across the various industries that we’re speaking to, what we’re finding is the more sort of government-led, or bureaucratic organisations, it can be a bit of a longer lead time. And it’s more the internal miscommunication or lack of discussion within the different departments and lack of visibility. So there are so many different stakeholders involved that manage their own silo sor of departments, which I guess is a standard supply chain occurrence. The smaller sort of organisations that are more agile, and SMEs, they’re definitely more on board and it’s a lot quicker because they realise that we can’t keep going the way that we’ve always been working.

Catherine Weetman 19:33 Mmm. And I guess, even if people think they can carry on because it’s worked so far, when you start to demonstrate the size of the savings that are available that you’ve experienced in some of the case studies, then I bet people’s eyes are really opening you know, lighting up.

Noreen Kam 19:51 Exactly. And it’s not just the immediate the cost savings, I guess a but the monetary cost savings but it’s everything in terms of – and you know Catherine! – the waste produced, just the amount of energy that goes into manufacturing. Just so much of the hidden costs as well that people aren’t capturing, and I think there’s more and more a corporate social responsibility programme within organisations and sustainability officers that are coming on board and that are the champions that are helping us lead that movement into those organisations as well.

Catherine Weetman 20:33 Yeah, and I’m thinking back to my podcast with circular computing, and some of the statistics that they were able to show their clients about the reduced energy and carbon required by buying remanufactured instead of new, you know, the reduced everything water footprint, the amount of obviously the amount of metal and plastic and so on that was required and providing that information. to clients was really useful in helping people not just make the business case but you know that it can go in environmental, social, social governments governance reports. And, you know, companies were using it for marketing and all sorts. So the, you know, as well as the monetary benefits, there are lots of other ways to make, make people realise that this really is the right way to go. And that, you know, that the old model of ownership is being replaced. And for some, for some sort of day to day products in certain countries, we’re, we’re already doing that. I mean, in in the UK. More people get cars on contracts these days, I think then, you know, new cars or newish cars on contracts, rather than, you know, going for a bank loan and shelling out £20,000 or whatever. Mobile phones in the UK are often on contracts. So we take that for granted. And it’s just that as you, as you say, so it’s just a mindset shift, starting to think differently about, you know, how do we keep this this piece of equipment in the system and make sure it’s, we’re getting the best use out of it.

Noreen Kam 22:17 I remember that information, the infographic that you gave about the computer, which there was 1200 kilogrammes of mining minerals for to generate one laptop and you know, that’s still an image that sticks out in my ankles in my mind constantly and but we continuously educate people within the industry about because if you think about a laptop that’s under three kilos, and 1200 kilos that goes into that, imagine the amount of minerals that are extracted to produce the assets that we’re moving. Yeah, exactly.

Catherine Weetman 22:53 And once you start to look into the supply chains of metals and minerals, the story gets even worse. It’s not just about the amount of waste but the destruction of environments and displacement of local communities and you know, conflict minerals and all that kind of stuff is all tied up with a lot of the stuff that goes into technology, as you will know better than me probably. So, in terms of companies that provide these assets and equipment, starting to switch on to selling services instead of selling products, are you noticing more interest and more offerings in that direction now?

Noreen Kam 23:39 So one thing that I guess in the current climate with COVID, I would say a lot of organisations are also realising that they don’t need that the physical space or they’re looking at their manufacturing processes or being more Lean and Agile in terms of things. So we’ve seen the asset base grow significantly over the last few months, just because people are shifting over the way they operate and making sure they get maximum value out of the assets that they do have.

Noreen Kam 24:13 I think that answers your question

Michael Brown 24:15 I think one of the elements though it certainly is behaviour variance in some situations. I think in our exposure, there are some OEMs that are very good and do practice circular economy principles and through lease capability or Lifecycle Management of their assets, and try to run their assets very closed-loop. So they, they recover the asset and end of life and redeploy the asset. So they’ve got a LUP model which sits internal to their own capability. There are others that are still in the mindset – and it’s a terrible thing to say, but in spite of what might be on their web page relative to corporate social responsibility, and regenerating assets, there are some that just simply don’t practice it, and are still focused on providing – selling assets to people is their principal business. And so there’s still a lot that can be done to encourage the full lifecycle use of assets, the OEMs a real player, and so we’re trying to fit in behind the OEM and partner where we can. That is true to say that some of the OEMs though car model is being counterproductive to their own goals. That is a worry

Catherine Weetman 25:26 Yeah. But I think I think, you know, there’s a shift starting to happen and just go into Circular Computing. a month or so ago, I think it was one of the laptop manufacturers that they remanufactured not on behalf of, but just to explain better Circular Computing were remanufacturing high-end laptops like HP, Lenovo and Dell, but they were procuring those, you know, pre-used ones themselves and then HP has ended up partnering with Circular Computing and selling the remanufactured HP laptops, on the HP website. And that was kind of sparked by the increased demand for laptops with people working at home. But it just kind of it’s, you know, it’s now become a sort of mainstream product, and they’ve realised the value of having both offers new and, you know, pre-used and, high-quality remanufactured. And it lasts for, you know, another three, four or five years. And I think companies are starting to see that if they don’t do that, as I said, in one of my blogs, you’re leaving value on the table for somebody else. What’s to stop somebody coming in and selling refurbished or remanufactured equipment that you made and somebody else is making money out of that. So doesn’t it make sense to do that yourself and keep the life and keep the value and all those things – the equipment that you’ve put so much time and effort into designing and testing and marketing and all the rest of it?

27:08 Yeah, definitely. And not just the OEMs. But that’s one critical element of the LUP model is the service partners, that they can go and support those assets as well in the second life, and we’re building our network of those service partners to support that where the OEMs might not, it’s not necessarily that they, it could be just capacity, sheer capacity, or something, that they need to focus on the R&D and the innovation. So that technology is always improving, but the service partners that can go and support this is critical, because then it can extend the life but then it provides that secondary market for it as well.

Catherine Weetman 27:56 Yeah,exactly. So looking back on the last few years on all the trials and tribulations and learnings of getting this service out to the market. And what would be your top tip for anybody looking to start a circular model?

Michael Brown 28:15 It comes down again to the action of discipline around managing the asset recording the use of the asset. It’s just a practice that we get quite shocked at that just doesn’t exist. And so people need to consider that I might have a finite life for my asset, but the asset has an extension post my use, and to maximise that, to have a good programme around managing the asset recording its use maintaining its warranty is to my mind, one of the big critical breakthroughs that the many people could make and that helps them extend asset life. You know, in any situation, buying something that’s underutilised, you have a level of concern about that. But mitigating that concern through good record keeping and good maintenance records is essential. And that’s it The an element that everybody we talked to we’re trying to foster that and grow that the application of those principles.

Catherine Weetman 29:08 Yeah. And as you said earlier, you know, it’s, we do it without thinking in some examples, don’t we like the car, you wouldn’t not fill the service logbook, log back in, and then expect to, you know, command, the most value when you come to sell the car at the end of the day, right?

Michael Brown 29:27 When you when you’ve got $100,000 piece of assets sitting in a health provider, and a new piece comes along that’s better and got new features, more algorithms to then put that asset that you’ve only had for a limited period and the scrapping which happens, just highlights the opportunity that’s there. And that’s the thing that we’re trying to champion and drive through our model.

Noreen Kam 23:39 So for any organisation that wants to get started, we’ve made it really simple. Whether you’ve got a maintenance regime or not, it doesn’t matter. We can help work with you to start proactively registering your assets within our Circular Asset Database and network. If you’ve got assets within the laboratory and life sciences sector as that’s the primary type of assets we’re focusing on currently. So the only thing you need to ask yourself is, do you currently own these type of assets? If the answer is yes, then you should really consider getting in touch with us & registering them with LUP.

Catherine Weetman 30:14 Yeah, brilliant. So Noreen and Michael, how can people get in touch and find out more about all the brilliant stuff that LUP Global’s doing?

Noreen Kam 30:21 So you can get in touch with us via our website www dot LUPGlobal.com and or info@LUPGlobal or connect with us on LinkedIn as well. So you’ll have our details within the podcast information I’m sure

Catherine Weetman 30:37 yeah, that’s right, I’ll put those links in the show notes so people can look you up and, and, and connect. And hopefully, find out more about how LUP Global’s circular asset management can help those companies. You know, save money and do some good for our planet and society. Brilliant. So thank you very much for breaking into your evening in Australia to talk to me this morning. And it was great to catch up with you both again, and look forward to hearing about what’s next in the circular asset services and other great things that you’re doing. Thank you. Thank you.

Want to find out more about the circular economy?

If you’d like to learn more about the circular economy and how it could help your business, why not listen to Episode 1, or read our guide: What is the Circular Economy?

To go deeper, you could buy Catherine’s book, A Circular Economy Handbook for Business and Supply Chains This comprehensive guide uses a bottom-up, practical approach. It includes lots of real examples from around the world, to help you really ‘get’ the circular economy. Even better, you’ll be inspired with ideas to make your own business more competitive, resilient and sustainable.

Please let us know what you think of the podcast – and we’d love it if you could leave us a review on iTunes, or wherever you find your podcasts. Or send us a Tweet: @Rethink _Global.

Podcast music

Thanks to Belinda O’Hooley and Heidi Tidow, otherwise known as the brilliant, inventive and generous folk duo, O’Hooley & Tidow for allowing me to use the instrumentals from the live version of Summat’s Brewin’ as music for the podcast. You can find the whole track (inspired by the Copper Family song “Oh Good Ale”) on their album, also called Summat’s Brewin’. Or, follow them on Twitter.